Airbnb Which Number to Use for Taxes 1099 K

I am working on my own taxes. I have been doing Airbnb and am doing 2019 taxes.

Airbnb Taxes What Taxes Do I Need To Collect On My Airbnb Bookings

Any Form 1099-K issued to you will be available in your Payout Preferences.

. Even if you didnt receive a 1099. Ad Avalara makes it easier to apply the right tax on Airbnb bookings. Here is a sample entry from Airbnb.

If youre using the Keeper Tax app to file you can simply upload the form and well do the rest. Whether Airbnb sends you a 1099 form or not may depend on how much you make during the year. Youll receive an email notification when your.

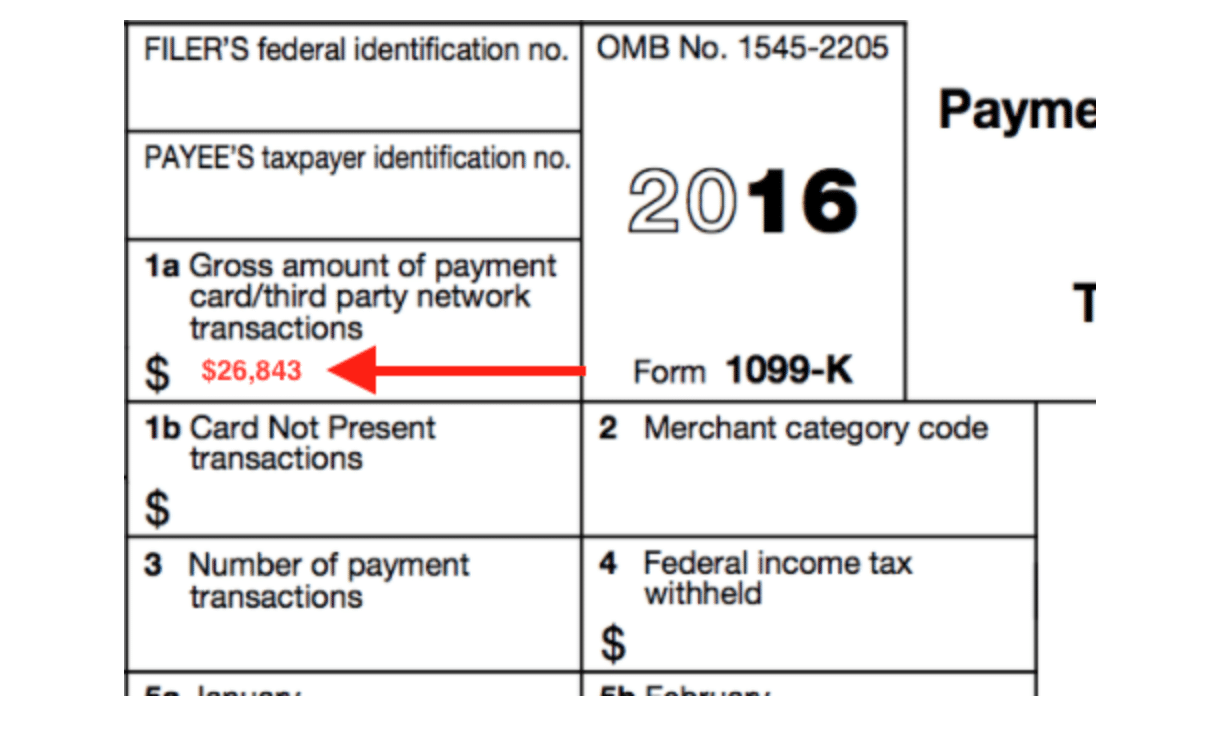

The total amount of management fees in this case is. Form 1099-K Payment Card and Third-Party Network Transactions is an IRS information return used to report certain payment transactions to improve voluntary tax complianceYou should receive Form 1099-K by January 31st if in the prior calendar year you received payments. Although my Airbnb gross income is just over 1000 my Airbnb net income does not exceed the minimum taxable income for independent contractors.

This will net taxable income to zero. Beginning in 2022 the payee must be issued a Form 1099-K if the service processed more than 600 worth of payments regardless of the number of individual payments or transactions. Do report the 1099-K amount on form 1040 Line 21 Other Income with the description AirBnb 1099 Do report the 1099-K amount again as a negative number on form 1040 Line 21 Other Income with title Non-Taxable AirBnb 1099 - see attached Sec280A Statement.

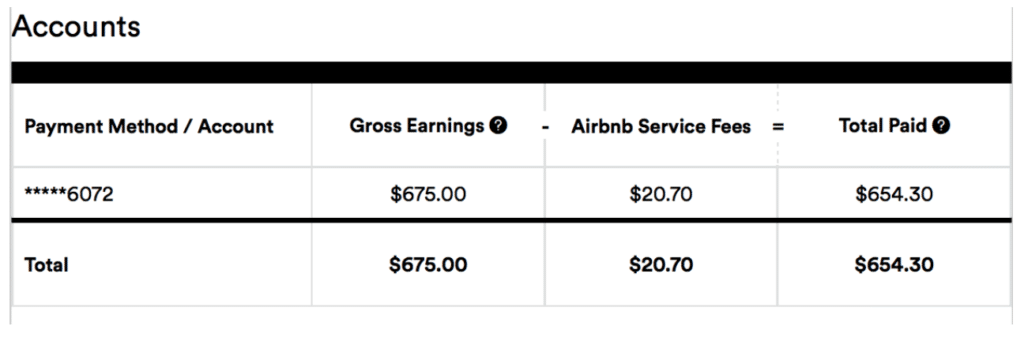

Its not actually easy to get a report that amounts to the gross earnings shown on the 1099-K. The form varies depending on your state but applies to both rental hosts and service providers such as photographers translators or. The IRS is only concerned with you reporting the rental income.

Airbnb issues form 1099-K if you pass 200 transactions or earn 20000 in gross revenues or Gross Earnings according to Airbnb. All of Airbnbs reporting is also based on the actual amounts sent to my bank. As a result of ARPA Airbnb must issue Form 1099-K for all US citizen or tax resident Hosts earning over 600 effective January 1 2022.

If you are providing services to Airbnb clients like dry cleaning or breakfast you are taxed and take deductions as a small business. For example I would go about it like this. Calculate state and local sales and lodging taxes even for out of state properties.

Taxes without a 1099-k. In TurboTax we dont create a separate entry for your 1099-K info. The IRS page on the 1099-K isnt really helpful on this matter.

You are allowed to recover the withholding to the extent allowed by claiming a credit. Once you receive a 1099-K youll need to report the exact amount shown in box 1a as gross receipts. Ad TurboTax Tax Experts Are On Demand To Help.

Id have to go to each individual transaction extract the host fees and manually create a spreadsheet to. Federal Income Tax Withholding If you did not provide Airbnb with your appropriate tax information such as your social security number Airbnb may have withheld income taxes from your payments. From payment card transactions eg debit credit or stored-value cards andor.

How to use the 1099-K at tax time. The withheld amount will be reported on Form 1099-K box 4. If you are using your home for rental purposes only you report your taxes on Schedule E of Form 1040.

Youll receive an email notification when your form is ready typically in late. Delivery of Form 1099-NEC Form 1099-MISC. I rent and live in an apartment owned by my friend.

Then report any fees or commissions as deductions separately. If you exceed both IRS thresholds in a calendar year Airbnb will issue you a Form 1099-K. From payment card transactions eg debit credit or stored-value cards andor.

100 Accurate Expert Approved Guarantee. For freelancers and independent contractors youll refer to any 1099-Ks you get when you file your taxes. I have no employees and use my SS my tax number.

The amount in box 1 of your 1099-K should be reported under gross receipts on your Schedule C. TurboTax Tax Experts Are Here To Help At Any Step As You File Your Taxes. The service processed more than 20000 worth of payments and.

1 day agoThe new rule requires third-party settlement organizations which also include Etsy and Airbnb to issue users and the IRS a form 1099-K for business transactions that exceed 600 in a calendar year. If you have less you wont receive a formal 1099-K form. Do I need to file my earned income through Airbnb even if I did not make more than 20000 or had 200 reservations warranting a 1099-K.

If you operate multiple Airbnb accounts you may receive more than one tax form. Any Form 1099-NEC andor 1099-MISC issued to you will be available in your Taxes section of your Account. The amount you can write off for Airbnb expenses depends on how you pay your business taxes.

If you have over 200 reservations and make over 20000 per year Airbnb will send you an IRS Form 1099-K. Simply enter the applicable amount for each property address on your Schedule E. You may receive more than one Form 1099-K if your taxpayer information is listed on multiple Airbnb accounts.

Am I a schedule C schedule K or Schedule E. The most common methods for dividing an expense are based on the number of rooms in your home or based on the square footage of your home. The Service Fees and Adjustments also need to be reported as deductions against income which we will talk about in the next section.

Thats because your 1099-K income should already be included in other income such as a 1099-MISC. Airbnb 1099-NEC vs 1099-K forms As an independent contractor for Airbnb you have to file a 1099 tax form for your gross earnings to the IRS. Fast forward to now when his accountant reached out to us with a 1099-K Airbnb filed with my name no social security number registered to my bosss PO Box address for 150000 in income paid in 2019.

Using the sample above the amount that you report on your tax return is the Gross Earnings which in this case was 15522. To confirm our Hosts US tax status and otherwise issue accurate information returns youll need to provide taxpayer info for yourself and any beneficiaries of payouts by completing Form W-9 W-8ECI. Delivery of Form 1099-K.

Is Airbnb a good tax write-off. Assuming I have a 4 bedroom 2 bath home that also has a kitchen and living room we would have 8 rooms to consider and the number 8 would be used as the.

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb Liability Insurance Helps Limit Your Exposure Do You Have The Right Coverage We Have The Answers To All Of Your Air Airbnb Host Hosting Hosting Guests

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Comments

Post a Comment